The financial technology (Fintech) industry is rapidly changing the way we achieve our money. From continuous mobile expenses to personalized investment advice, Fintech is making investment more reachable, helpful, and effective. But what does the future hold for this dynamic sector? Here, we explore 10 of the most significant Fintech developments composed to shape the next decade:

Embedded Finance:

Consider asking for a loan or managing your savings directly from your preferred budgeting tool. Embedded finance smoothly integrates financial services into the apps and platforms that customers already use. This reduces the need to navigate between several apps, allowing users to make up-to-date financial decisions inside their current processes.

Open Banking:

Open banking allows third-party providers to access consumers economic information with their authorization. This information can be used to offer a greater range of financial products and services personalized to individual needs. Open banking promotes competition and revolution in the financial sector, resulting in a more modified and competent financial experience.

This opens up a world of possibilities:

-

-

Personalized financial products: Apps can assess your spending habits and recommend budgeting tools, lower interest rates, or personalized investment changes.

-

-

- Efficient money management: Organize your accounts from many banks in one spot.

-

- Effortless payments: Pay immediately from your preferred shopping app without switching platforms.

Open banking enables you to leverage your financial information to create a more appropriate and comprehensive financial experience.

Decentralized Finance (DeFi):

DeFi, or Decentralized Finance, removes the midway. It effects blockchain expertise to figure peer-to-peer economic networks, allowing you to borrow, lend, and invest directly with others. Consider receiving a loan or earning interest on your funds without a bank account. DeFi offers:

-

- Accessibility: Bank from anywhere with an internet connection.

-

- Transparency: Secure blockchain technology records all transactions.

-

- Innovation: Investigate advanced financial goods and services that are not limited to existing organizations.

DeFi is still growing, but it has the power to alter how we manage our money on a universal scale.

AI and Machine Learning: The Future of Financial Automation

AI and machine learning (ML) are already altering financial services by automating tasks, adjusting commendations, and managing risks. AI is predicted to advance in areas such as fraud detection, algorithmic trading, and wealth management during the next decade.

AI-powered chatbots will offer 24-hour customer service, while automatic investment platforms will make sophisticated financial products more reachable to a wider audience. Furthermore, Artificial Intelligence will improve credit scoring procedures, allowing for more exact assessments of wealth and allowing better loan acceptance. Predictive analytics enabled by AI will provide deeper perceptions into market trends, allowing investors to make more informed decisions.

Blockchain: Beyond Crypto currencies:

Blockchain technology, beyond its connection with crypto currencies, is fixed to transform Fintech over the next decade. It offers increased security, transparency, and efficiency in financial transactions.

Blockchain will shorten procedures like cross-border payments, lowering costs and settlement times. Smart contracts will power and impose contractual arrangements without the need for middlemen, thereby improving trust and reducing fraud. Additionally, blockchain will provide secure and irreversible record-keeping, which is critical for agreement and auditing.

As technology spreads, it will shoot innovation in areas such as decentralized finance (DeFi), asset tokenization, and digital identity verification, fundamentally altering the financial setting and boosting access to financial services.

The Rise of Fintech Neobanks: Challenging the Status Quo:

Fintech neobanks are quickly developing as serious competitors to traditional banks, altering the financial environment through their creative ideas. Key points include:

-

- User Experience: Neobanks arrange fluid, user-friendly digital borders to attract tech-savvy customers.

-

- Cost Efficiency: Because their working expenses are lower, companies may charge higher interest rates and offer more reasonable fees.

-

- Personalization: Using AI, they offer modified financial products and insights.

-

- Accessibility: They cater to immature markets, providing financial services to those who do not have typical bank accounts.

The Internet of Things (IoT) in Finance: The Connected Economy

The Web of Things (IoT) is set to convert fund, introducing in a related economy. In fintech, IoT gadgets will give real-time information for upgraded decision-making and chance evaluation. Savvy sensors and wearable will empower adapted protections payments based on person behavior and wellbeing measurements.

IoT will update installment forms through associated gadgets, moving forward exchange speed and security. Also, IoT will improve resource management by giving precise following and checking. As IoT invention managing further into monetary managements, it’ll drive effectiveness, personalization, and development, eventually making a more responsive and interconnected monetary environment.

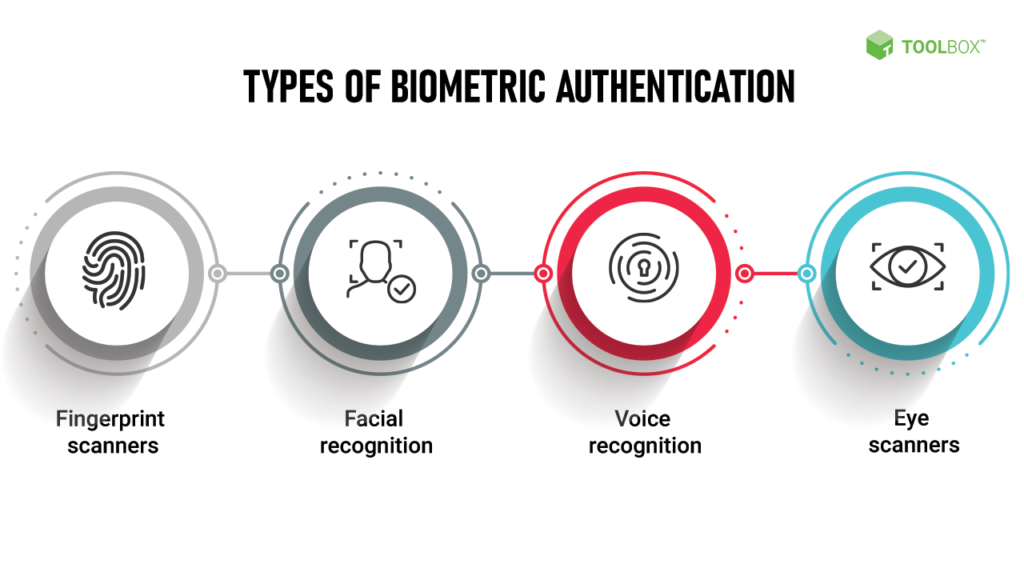

Biometric Authentication: Security at Your Touch:

Biometric authentication is changing security in Fintech, offering matchless protection through unique physiological qualities. Over the next decade, enhancements in fingerprint, facial recognition, and iris scanning technologies will enhance identity verification processes, reducing fraud and illegal access.

These methods provide a continuous user experience, removing the need for passwords and PINs. Fintech applications will increasingly adopt biometrics for transactions, account access, and identity verification, ensuring secure and effective services. As biometric technology advances, it will set new standards for security in financial services, fostering trust and confidence among users while streamlining verification processes across the industry.

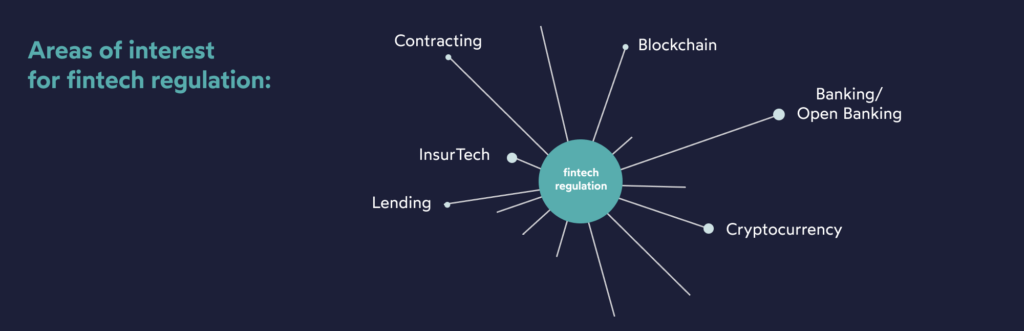

Regulating Fintech: Striking a Balance

Maintaining consumer protection but promoting innovation is a delicate balance that must be struck when regulating fintech. Efficient regulations need to keep up with the quickly changing technologies to avoid fraud, data breaches, and systemic threats.

Market stability and responsible innovation will be promoted by well-defined rules and regulations. Regulators and fintech companies must work together to provide a framework that fosters growth without impeding innovation. Dynamic and adaptable regulatory strategies will be necessary as the fintech sector grows in order to protect user interests, uphold confidence, and foster a healthy, competitive climate that benefits the financial sector as well as consumers.

The Future of Work and Fintech: Serving the Changing Workforce

Fintech is changing to well serve the modern workforce as a result of changes in job structures and technology innovations that will affect the nature of work in the future. Fintech solutions are evolving to provide flexible financial services including fast payments, microloans, and customized financial planning in response to the development of gig and remote labor.

Digital banking platforms offer capabilities for tax administration, invoicing, and budgeting that are tailored to independent contractors. Computerized savings strategies and AI-powered financial guidance are also becoming necessities. Fintech will be essential in meeting workers’ varied demands by offering customized, easily accessible, and effective financial services as the labor market continue to change.

Conclusion:

The following decade guarantees transformative progressions in Fintech, in a general sense changing the money related scene. From implanted fund and open managing an account to AI-driven mechanization and decentralized back, these developments will upgrade openness, effectiveness, and personalization of money related administrations. As neobanks rise and IoT and blockchain advances develop, the division will see uncommon integration and security changes. Striking a adjust between control and advancement will be pivotal to cultivating a sound, competitive environment. Eventually, these advancements will engage buyers and reshape how we connected with and oversee our funds, driving to a more comprehensive and energetic budgetary environment.